Invest

Market

In 2018 stock markets were hit by the highest level of uncertainty seen for a long time. This was particularly evident towards the end of the year, when trade wars, interest rate rises and some incipient weakness in leading indicators made investors nervous. Stock markets fell quite sharply through the fourth quarter, and there was increasing talk of parallels with the 2008 market crash. The Nordic stock market fell 6% in 2018, the European market fell 11%, and the world index was down 9%. Behind these figures there were significant differences in the returns generated both by individual shares and sectors. Following the significant upturn seen since the start of 2019, the weakness in stock markets seen in 2018 seems so far to have been a correction.

Return

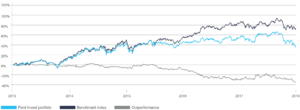

Ferd Invest’s portfolio produced a return of -10.8% in 2018, which is 4.9 percentage points weaker than our benchmark index, the Vinx Nordic index. Having been over 7 percentage points ahead of the index in June, the second half of the year was more challenging. The investments that played the largest role in our negative relative return were ThinFilm and Otello (formerly Opera), which together reduced the return on the portfolio by 5.5 percentage points. In addition, our two big investments, ISS and Nokian Renkaat, fell by somewhat more than the market. The portfolio’s weak performance in the second half of 2018 can also be explained by the fact that Norwegian rose sharply going into the summer on the back of reports about a possible take-over by IAG but then fell back, in part because this did not come to pass. Dometic and Elkem were also positive contributors going into the summer, but these fell back sharply as well due to turmoil about the possible effects of a more serious trade war.

The investments that made the biggest positive contribution to the portfolio’s 2018 return were Elekta, Lerøy, Hexagon, TDC and Norwegian.

In 2018 Ferd Invest made some targeted changes to its portfolio to increase its liquidity, with the business area now focusing to a greater extent on larger companies with better liquidity in their shares. The portfolio still contains some small companies, such as ThinFilm and Cxense, but we disposed of our holdings in Otello over the course of the year.

Rolling five-year return

Over the last five years, the Ferd Invest portfolio has produced a satisfactory absolute return, but its relative return over the last few years has been weak. It is primarily the three least liquid investments in the portfolio, namely ThinFilm, Otello and Cxense, that have contributed to this, but H&M and Norwegian have also been a drag on the portfolio’s performance. The investments that have made the greatest positive contribution over the period are Hexagon, Autoliv, Outokumpu, Mowi (Marine Harvest), Thule, Lerøy and Elekta.

Portofolio

The market value of Ferd Invest’s portfolio at 31 December 2018 was NOK 3.6 billion. The portfolio’s investments are divided between the three Scandinavian stock markets, as well as the Finnish stock market. The largest investments at the close of 2018 were Novo Nordisk, Norwegian Air Shuttle, Nokian Renkaat, ISS and Essity.

Organisation

At the end of 2018 the Ferd Invest team consisted of only Lars Christian Tvedt, as Nicolay Mylen moved over to Ferd Capital during the course of the year. Joakim Gjersøe was appointed in November 2018, and he will take up his new role on 1 March 2019.